The South Australian Business Chamber, William Buck Survey of Business Expectations for the June 2023 Quarter, underscores a significant drop in business confidence and conditions drawing comparisons to the aftermath of the Global Financial Crisis (GFC).

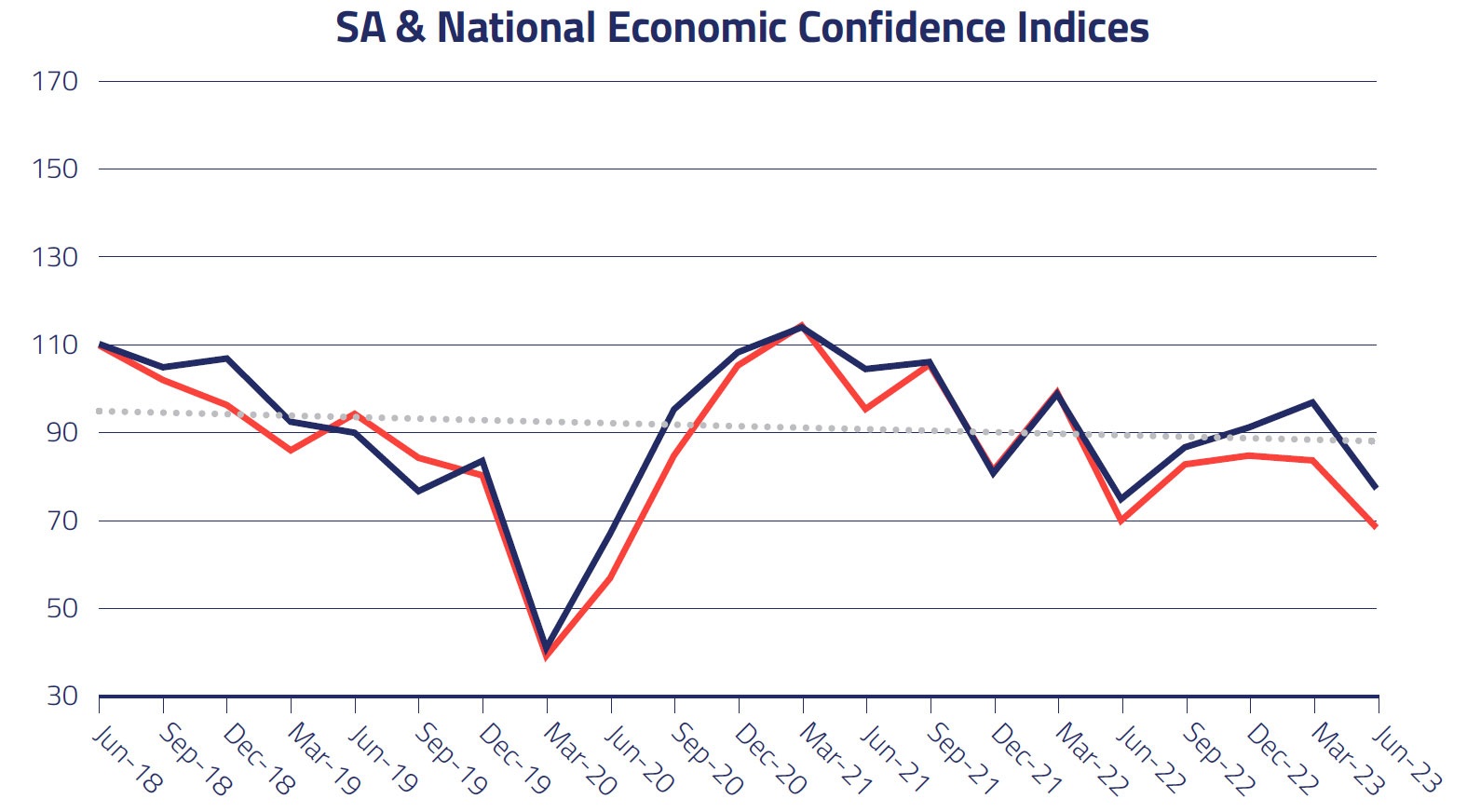

The survey’s findings spotlight a substantial 19.6‑point plummet in South Australia’s business confidence index, a key metric for forecasting economic conditions. This index has declined from 96.9 to 77.3.

To provide context, the average confidence index over the past decade stands at 88.3 points, while it registers at 90 points over the last two decades. Interestingly, the June downturn follows three consecutive periods of confidence growth.

Respondents’ projections for the national economy are even more stark this quarter, indicating an anticipated 15.4‑point decline in confidence to reach 68.4 points in the September quarter. This would mark the lowest recorded confidence level (except for 2020 during the peak of the COVID-19 crisis) since the GFC.

Chart — Survey of Business Expectations, June 2023 Quarter

Comments in the survey, which has been tracking business sentiment for 43 years, attribute this abrupt decline to the cumulative impact of rising interest rates on the economy.

Andrew Kay, Chief Executive of the South Australian Business Chamber says results reinforce discussions the Chamber has had with businesses over the past few months.

“It is clear that optimism stemming from positive growth in the previous year has now been dampened by an economic slowdown.

“Rising interest rates are constraining consumer demand, while added labour, energy and input costs are further squeezing businesses’ profitability.

“It would appear that the RBA’s 12 interest rate hikes are having their desired effect,” he added.

“Although our sales projections have materialised, and demand for our products has remained strong, our margins continue to shrink,” she said.

Petria Byrne — Byrne Vineyards — Photo, Fabio Migliaccio

The June quarter survey also showed a significant decline in the general business conditions index, which tracks businesses’ operational performance over the previous period. This index demonstrates a notable decline of 19.3 points from 105.9 to 86.6 points. The index had consistently been above 100 in the previous three quarters.

“Noting that the previous survey was conducted amid the buzz of AFL Gather Round, LIV Golf and another bumper festival season, to some extent, this survey may represent “the morning after the night before,” the Chambers CEO added.

Businesses have reported sales revenue for the June quarter falling short by 11.4 points compared to expectations outlined in the March quarter survey. This trend is echoed in other survey indices, including orders received, average selling price, employment levels, and profitability, which all highlight the recent slowdown in the economy.

Martin Hill, Director at William Buck notes that smaller businesses are disproportionately affected by these changes.“Those most severely impacted are often those who can least afford it, while businesses with more financial resilience continue to operate on narrower profit margins,” he said.

Martin Hill — William Buck — Photo, Supplied

The survey also delved into businesses’ perspectives on payroll tax, a levy imposed on businesses with a payroll exceeding $1.5 million. Respondents reinforced concerns this tax dampens hiring and growth prospects, contributing to stagnant wages and a lack of employment opportunities.

“It makes businesses consider keeping wages low by not employing people,” said one respondent.

“Many businesses stop growing when payroll hits the threshold or look for ways to grow without increasing staff. It’s not helping the economy prosper,” said another.

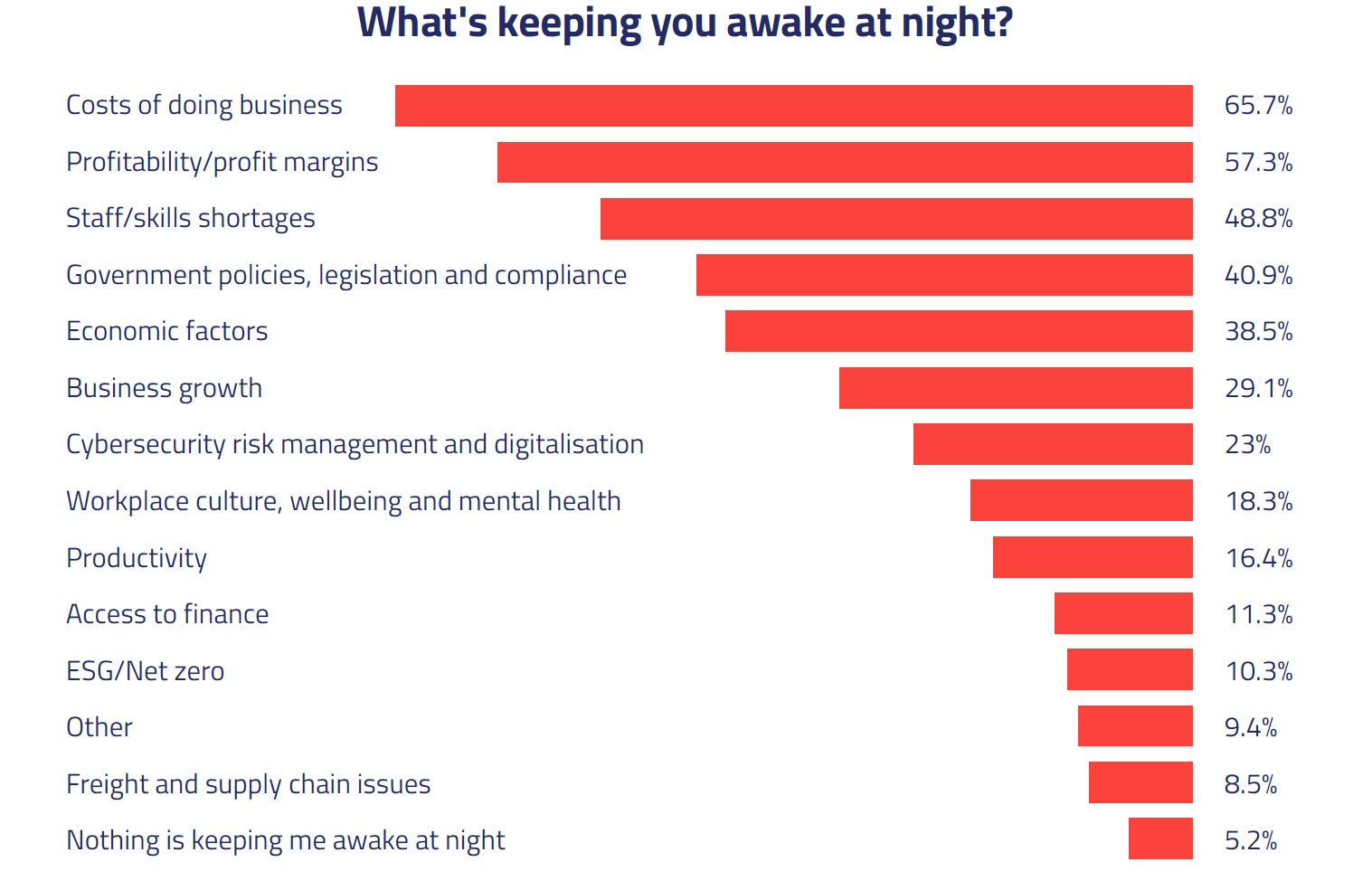

The June 2023 quarter survey of business expectations also underscores growing anxiety about the escalating cost of doing business, including wages, energy prices, and rent. 65.7% of respondents cited this issue as a significant source of concern, impacting their ability to sleep at night.

For a comprehensive analysis of the South Australian Business Chamber, William Buck June 2023 quarter Survey of Business Expectations, please visit business-sa.com/businessnow.